Tax Changes in 2026

As at the start of every new year, there are new regulations to be aware of as we enter 2026. We provide information about fundamental changes in tax law that are currently relevant to you.

Income/payroll tax

- Relief through higher basic allowances

- Increased deduction for childcare costs from 2025

- Declining balance depreciation

- Company car taxation on electric vehicles

- Cross-border wages

Profit taxes

- Foreign dividends

- Permanent establishment under treaty law

Other topics

- Business hospitality receipts

- Amendment to the VAT application decree to confirm a foreign VAT ID

- Prerequisite for claiming VAT exemption on export deliveries

- VAT exemption for services directly serving school and educational purposes

Income/payroll tax

Relief through higher basic allowances

| Basic allowance | NEW! | NEW! | |

|---|---|---|---|

| Assessment period 2024 | Assessment period 2025 | Assessment period 2026 | |

| Individual assessment | 11,784 € | 12,096 € | 12,348 € |

| Joint assessment | 23,568 € | 24,192 € | 24,696 € |

| Child allowance | NEW! | NEW! | |

|---|---|---|---|

| Assessment period 2024 | Assessment period 2025 | Assessment period 2026 | |

| Individual assessment | 3,306 € | 3,336 € | 3,414 € |

| Joint assessment | 6,612 € | 6,672 € | 6,828 € |

Increased deduction for childcare costs from 2025

New!

- From 2025: 80%, that is a maximum of € 4,800 per child per year for childcare by childminders and nurseries, will be tax-deductible (previously 2/3, i.e. a maximum of € 4,000).

- Applies to children up to the age of 14, with no age limit for children with disabilities

Nice To Know

- Also applies to supplementary services such as afternoon care or extracurricular activities, as long as they are recognised as childcare costs

- Expenses for lessons, teaching special skills, sports or other leisure activities are not deductible

- Even if the child is looked after at home by a childminder, costs can be taken into account

- Travel expenses, e.g. for care by grandparents, are also deductible, provided that there is a serious, mutually binding and obligatory contractual relationship

- Costs must be documented by invoices (or travel expense statements) and bank statements

Declining balance depreciation

Declining balance depreciation is being reintroduced to give companies the opportunity to write off investments more quickly. This regulation is expected to be temporary.

New!

- Useful if higher depreciation is desired and the useful life is at least four years or longer

- The depreciation rate is limited to three times the straight-line rate (equal annual amounts) and may not exceed 30%

- Only applies to

movable

fixed assets acquired/manufactured after 30 June 2025 and before 1 January 2028

Company car taxation on electric vehicles

In principle, the private use of a company car provided by an employer is taxed as a monetary benefit at 1% of the gross list price per month. For purely electric company cars, the tax rate is significantly lower – only 0.25% of the gross list price. For hybrid vehicles, on the other hand, 0.5% of the gross list price is assumed for taxation purposes.

New!

- Requirements for the lower tax rate: Gross list price does not exceed € 100,000 (previously € 70,000)

- Purchase after 30 June 2025

Cross-border wages

Working from home has become increasingly relevant, at least since the coronavirus pandemic, and now requires more documentation, e.g. regarding working days on site vs. working from home.

New!

- Salary is taxed in full in the country of residence if you do not work abroad for more than 34 days per year. If this limit is exceeded, double taxation agreements (DTAs) with the respective neighbouring countries regulate how income is divided so that it is not taxed twice:

- DTA Netherlands since 1 January 2026

- DTA Luxembourg since 1 January 2024

- DTA Austria since 1 January 2024

- When working abroad, the tax office checks who the economic employer is. In future, an "employer's certificate of cost coverage for submission to the tax office of residence" may be requested from the employer for this purpose.

Profit taxes

Foreign dividends

Nice To Know

Unlike the Parent-Subsidiary Directive for dividends between companies within the EU, dividends paid to a corporation based in a third country are not completely exempt from capital gains tax. The Federal Fiscal Court has now referred the question to the European Court of Justice as to whether this is compatible with EU law on the free movement of capital (Case C-533/25).

If the European Court of Justice rules in favour of companies from third countries, Germany would no longer be able to withhold withholding tax on dividend distributions to third countries (e.g. Japanese parent companies) or would have to refund it in full.

Permanent establishment under treaty law

If a taxpayer works in several DTA countries, it is questionable in which country their income from employment is taxed. One indicator for the allocation of taxation rights is whether there is a fixed place of work that qualifies as a permanent establishment within the meaning of the DTA (double taxation agreement).

In principle, the following criteria are taken into account:

- Centre of business activity

- Fixed business establishment, including a minimum duration of six months

- Permanent power of disposal over the business premises

- Office space is used for management activities and not just auxiliary activities

Ultimately, the assessment of whether a permanent establishment has been established depends on the interaction/characteristics of all the above factors and the overall picture.

Other topics

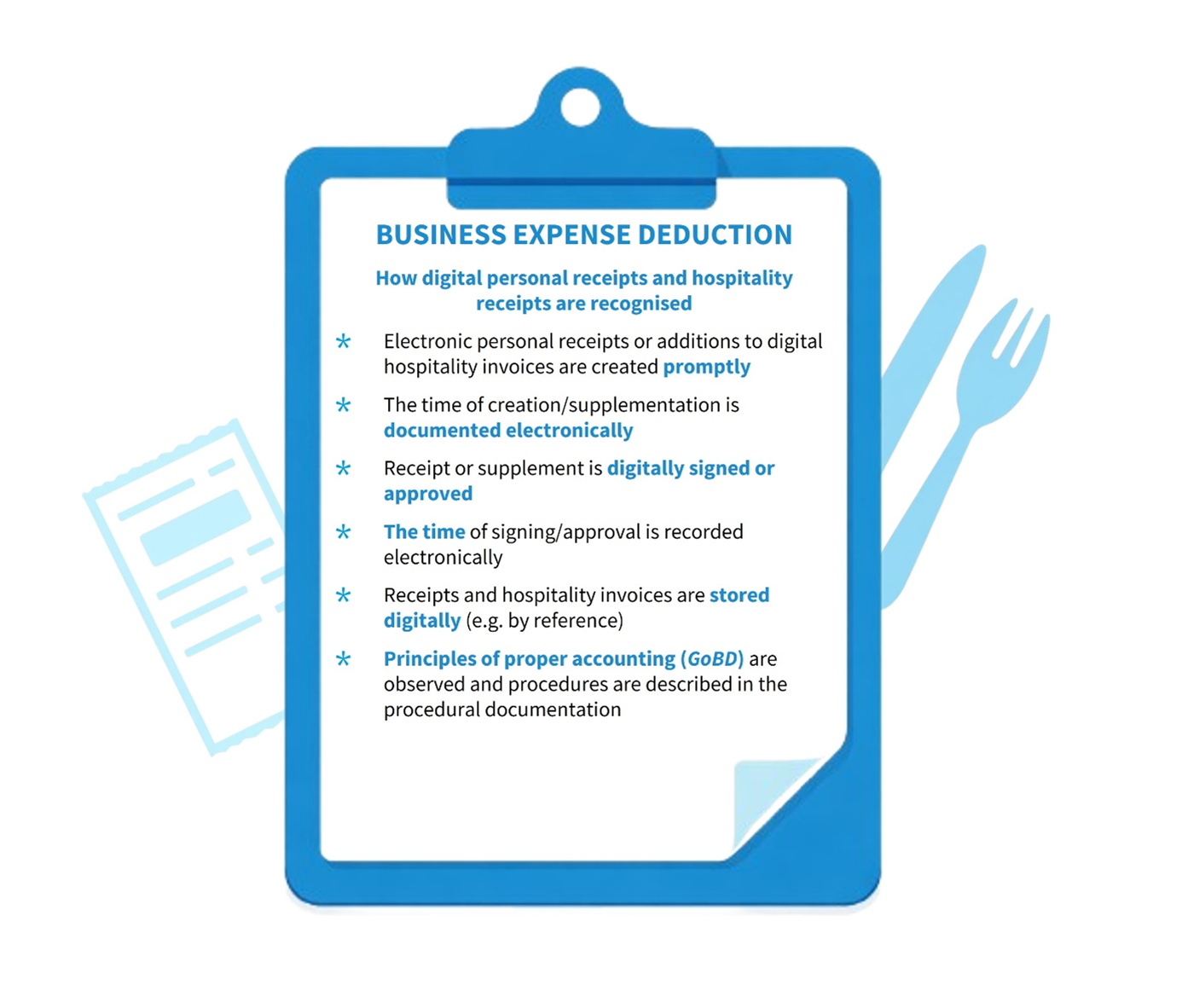

Business hospitality receipts

The Federal Ministry of Finance (BMF) has revised its letter on the income tax deduction of hospitality expenses and added the effects of e-invoices. The BMF letter is to be applied by the tax offices with retroactive effect from 1 January 2025.

New!

- An invoice for hospitality services can be sent to the taxpayer in digital form (no paper receipt required).

- A paper hospitality invoice can be digitised by the recipient.

- For the deduction of business expenses, it is sufficient if the digital or digitised personal receipt refers to the digital hospitality invoice or digital cash register receipt. All necessary information can also be included directly on the digital receipt or on a visualised e-invoice.

- Particularly welcome: a so-called other paper invoice (e.g. cash register receipt) can be corrected retrospectively by an e-invoice if it exceeds € 250 and is incorrect.

Amendment to the VAT application decree to confirm a foreign VAT ID

New!

Queries regarding foreign VAT identification numbers (VAT ID) have become an integral part of everyday business life. The Federal Ministry of Finance has now adapted the query methodology and included the following changes in the VAT application decree:

- Foreign VAT IDs can now only be queried online. Queries by telephone or email are no longer possible (link to query: BZSt VAT-ID query)

- Queries can only be made by holders of a German VAT ID number

- Multiple queries can now be made at the same time

Prerequisite for claiming VAT exemption on export deliveries

New!

One of the issues regularly discussed with the tax authorities during tax audits and VAT reviews concerns the very formal approach taken by the German tax authorities with regard to the requirements for claiming VAT exemption on export deliveries (so-called book and document evidence).

The German tax authorities have responded to the long-standing case law of the Federal Fiscal Court and the European Court of Justice and now accept proof of export even without confirmation from a border customs office or office of departure, provided that such proof is not possible.

VAT exemption for services directly serving school and educational purposes

With the Annual Tax Act 2024, the German legislature has expanded Section 4 No. 21 of the Value Added Tax Act (UStG). Accordingly, more institutions now receive VAT exemption for a wider range of services. Institutions under public law that are entrusted with services serving school and educational purposes have been added. The scope of eligible services has been extended to include "school education, higher education, training, further education or vocational retraining" and a separate exemption for private tutors has been added.

New!

- According to a new statement by the Federal Ministry of Finance, services in the field of vocational training, further training and retraining are also eligible for exemption. Services such as job application training or courses on performing life-saving emergency measures are also covered by this regulation.

- If recordings of the lessons (following an event) are provided free of charge, this is considered an ancillary service to the educational service, meaning that the VAT exemption regulations also apply here.

Nice To Know

Activities such as paid research conducted by state universities and the sale of food and beverages in seminar rooms are not covered by the exemption rule.